For anyone who’s looking to build long-term wealth, the first question that pops into the mind is: How do I start? When it comes to beginners, the entire investment process can feel extremely overwhelming, mainly because of so much financial jargon that you don’t seem to quite understand much. This is where SIP in mutual funds come into the picture. With its nature of being extremely easy to understand, SIP investments are one of the smartest ways a beginner can start investing.

What Is SIP In Mutual Funds?

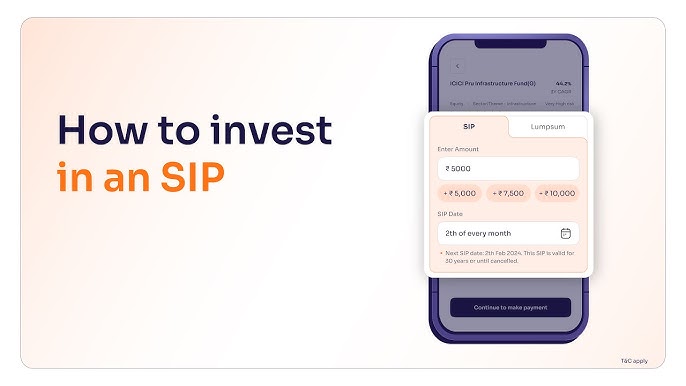

SIP stands for Systematic Investment Planning. Instead of having to invest a huge sum of money at once, SIPs involve investing small and fixed sums of money into a mutual fund scheme monthly or at regular intervals. These small investments turn into significant long-term wealth over time.

You can think of investing in mutual funds as planting a tree. You sow a seed, regularly look after and water it over time, only for it to grow into something strong and valuable. You won’t see instant overnight results, but once you stay consistent with your investments, it will turn out to be the best decision you made as a beginner.

Why Beginners Should Choose SIPs In Mutual Funds?

A mutual fund investment never requires you to invest a large lump sum amount of money at one go. Major reasons why beginners who are looking forward to starting their investment journey are:

- Low-Entry Barriers: You do not need thousands or lakhs of rupees to begin your mutual fund SIP. You can start with as small as Rs. 100 and then consistently make it bigger.

- Builds Discipline: Since SIP stands for Systematic Investment Planning, the amount that you have decided to invest automatically gets debited from your account. This turns investment into a habit and builds discipline.

- Minimal Risk: Compared to the share market, mutual funds pose a very minimal risk to your investments. This is because you are regularly investing in the market.

- Compounding Advantage: The longer you stay invested in mutual funds, the greater chance you have of growing your invested money.

SIP Investment vs Lump Sum Investment

As a beginner, the biggest question that would come to your mind is: Should I invest all of my amount at one go or start systematic investments?

To clear out this question, always remember that if you have a large amount of money that is just sitting untouched, then a lump sum investment might be the best option for you to go ahead with. SIP, on the other hand, is ideal for people who are looking for investment options that do not feel heavy on their pockets. With SIPs, you can start with the lowest possible amount and still have a chance to increase it in the future.

SIPs in mutual funds are the ideal way to begin your investment journey. Even if you have no clue where to start, just download a mutual fund app from the internet, and you will be all set to make your first investment. It is very reliable and eliminates the pressure of market fluctuations. The best part is you really do not have to be a finance expert to start with this; you just need to have an app, and you will be ready to make your first investment.